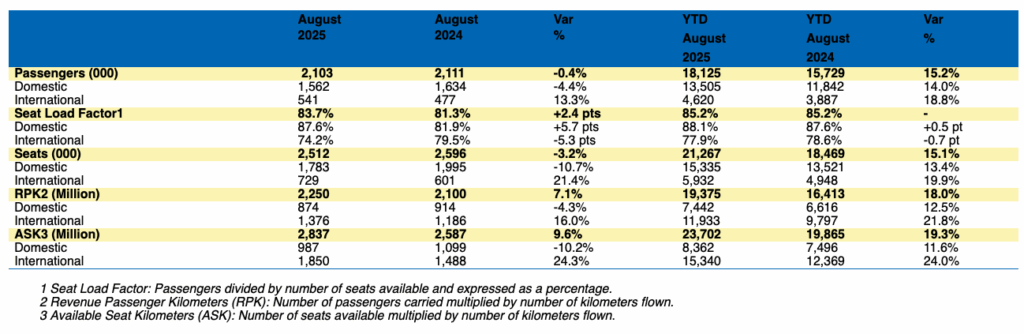

Cebu Pacific (CEB), the Philippines’ leading low-cost carrier, reported that it flew 2.1 million passengers in August 2025, slightly lower by 0.4% compared to the same month last year. Despite this dip in overall traffic, the airline’s seat load factor (SLF) — a key measure of how efficiently available seats are filled — rose to 83.7%, up from 81.3% in August 2024, even as total seat capacity declined by 3.2%.

The breakdown of traffic showed contrasting performances between domestic and international routes. Domestic passenger numbers slipped by 4.4% year-on-year, largely due to a 10.7% reduction in domestic seat capacity. However, this pullback in available flights resulted in better efficiency, as Cebu Pacific’s domestic SLF climbed 5.7 percentage points to 87.6%.

On the other hand, international operations painted a different picture. The airline carried 13.3% more passengers on its overseas routes compared to August 2024, supported by a 21.4% increase in international seat capacity. However, the rapid growth in available seats led to a decline in utilization, with international SLF falling 5.3 percentage points to 74.2%.

From January to August 2025, Cebu Pacific carried a total of 18.1 million passengers, marking a strong 15.2% increase compared to the 15.7 million passengers recorded in the same period last year. Of this, domestic travel contributed 13.5 million passengers, up 14% year-on-year, while international passenger traffic rose 18.8% to 4.6 million. The airline maintained an average SLF of 85.2% for the year-to-date, while its overall seat capacity grew by 15.1% to 21.3 million.

Cebu Pacific CEO Mike Szucs attributed the slight downturn in August to seasonal travel patterns, noting that August typically falls within the lean travel season in the Philippines. “The softer year-on-year traffic in August reflects the usual lean travel season in the Philippines, particularly for domestic routes, while international passenger growth remained strong. We see this as an expected and temporary dip, with traffic rebounding in the fourth quarter as peak travel season begins and aircraft availability improves. We moderated our domestic capacity growth in August due to some unscheduled engine removals, the flyadeal wet-lease, and scheduled maintenance events in preparation for the busy holiday months. These actions enable our capacity to be optimized so that we can deliver higher growth in the fourth quarter to coincide with the anticipated strong demand,” Szucs explained.

He added that the airline had to moderate its domestic capacity in August due to operational constraints, including unscheduled engine removals, the flyadeal wet-lease arrangement, and planned maintenance work. These adjustments, Szucs said, were strategic preparations for the busy holiday months ahead.

Cebu Pacific is banking on strong passenger demand in the last quarter of 2025, particularly during the peak holiday season. With its network expansion and fleet adjustments in place, the airline expects a rebound in both domestic and international traffic to support its growth momentum.